Steadfast

- Aug 31, 2023

- 8 min read

I hope this summer has treated you well and that you were able to shield yourselves from the relenting heat plaguing the south. For our Dallas readers, you may find comfort in knowing that this week historically marks the end of average hot temperatures meaning the hottest part of the year is nearly over. Now, as always, these few degree drops won’t make a lick of difference as I still get the subtle bead of sweat on my brow the second I leave my air-conditioned sanctuary dressed in my traditional full suit finance-bro regalia. Nevertheless, there is some comfort that the worst of this heat is hopefully behind us.

Unfortunately, the same cannot be said with regard to the economic outlook and financial markets. I know there has been a lot of discussion revolving around a soft-landing economic scenario which has manifested from a rather peculiar equity rally. But while the equity rally has left most people in awe, it has not been indicative of a new and durable bull market. Now add renewed inflation worries to the mix with many other slowing economic signals, and you see that the path higher of risk assets remains challenging, at least in our humble opinion.

Today’s Coffee with Andrew will review why the soft-landing narrative may be misguided and why we remain Steadfast in our defensive equity positioning within risk assets, as well as the overweight to cash equivalents.

DCA Thesis

It seems and feels like an eternity ago when we first began ringing the warning bells in October 2021. If you recall, the Fed was embarrassingly behind the curve and naively committing to the “transitory” argument for inflation. Market (long-term interest) rates, which are rates above and beyond the Fed Rate, essentially had fired a very loud warning shot across the bow to the Federal Reserve to give them the signal that they needed to begin restricting policy. Fast forward a few months, and the Fed embarked on the fastest tightening cycle in over 50+ years and has continued to raise rates well into 2023. The chart below shows the magnitude and duration of the change in Federal Reserve monetary policy since the 1970’s. You will see the current policy path even eclipses the speed at which rates were being raised rates during the Great Inflationary environment. Though the level of rates were substantially higher during the 70’s, the speed at which our current Federal Reserve is tightening monetary policy is no less impressive. It was under Volcker’s administration that he raised rates significantly, thus putting an end to entrenched inflation. As a side note, Arthur Burns was the Federal Reserve Chairman before Paul Volcker during the beginning of the Great Inflationary regime.

The quick pace of tightening in financial conditions paved the way for ALL assets to be repriced/revalued, given that interest rates, also known as discount rates, moved substantially higher in short order. The important outcome of this transmission mechanism was the move lower in asset prices in an effort to reflect the meaningfully higher interest rate environment. This effect from monetary policy is a critical component of our DCA Investment Strategy which leads us to believe that this slowdown is occurring in 2 distinct phases: Phase 1, which commenced in 2022, was a repricing of assets given the Federal Reserve embarking on the fastest tightening campaign and Phase 2 is our impending thesis that a credit(economic) slowdown is underway.

But of course, this Phase 2 is being challenged as many economists, investment practitioners, and media pundits have anchored on the recent market rally that has shrugged off the year-to-date bank failures, negative rating change for the U.S., rising credit card and auto loan defaults, and the deterioration in the Chinese economy. And sure, we, too, are surprised that the market has been this resilient in the wake of some startling headlines. Nonetheless, the data we analyze puts the soft-landing outcome as a low probability.

Soft Landing

It goes without saying that sentiment has turned remarkably bullish as the recent market rally has been followed by the highest investor “bullish” sentiment since 2021, increased earnings expectations, and increased Wall Street 2023 year-end price targets. But what exactly has changed? It is not economic data as that has been continually contracting. The Fed has raised rates leading to the third year of bond losses (the first time in history); energy and food prices are moving higher (again); and data out of China and the Euro Area are abysmal- all of which are not positive catalysts. So, to us, the only thing that has improved is simply the valuation of the equity market, which is based on the hopes and dreams that the U.S. will achieve a soft landing. As a side note, the reason I say the only improvement in the valuation is due to the fact that this year's market has seen prices of equities move higher while realized earnings have slowed. In a quote from the WSJ on May 4th of this year, it cites how “Jerome Powell, Federal Reserve Chair, thinks his central bank can defy history to clinch slower inflation and a soft economic landing.” This expectation has grappled the market, which is evident based on recent news trends using Google Analytics, shown in the chart below. The takeaway- no one is pricing in a recession.

Now to be fair, the optimal outcome would obviously be a soft-landing scenario where prices cool, labor and wages remain tight, and economic growth barely slows. The reality though is that this outcome would further entrench inflation, thus leading to wage-price spiral dynamics, a phenomenon where higher wages put upward pressure on the prices of goods sold. This is the same style of inflation that led to the Great Inflation regime during the 70’s. In truth, we have already begun seeing evidence of wage-price spiraling. The recent announcement from UPS and the 150,000-member United Auto Workers union demanding a 46% wage increase with 32 work weeks, and if not achieved, will be reinforced with Canada’s 315,000 Unifor Union. So, while a soft landing sounds great in theory, the outcome could pose a significant inflationary challenge.

Nonetheless, our DCA Investment Committee has yet to see evidence that supports a soft-landing scenario. As always, “this time could be different,” but our work on Monetary Policy, Interest Rates, Inflation, and Liquidity (PIIL model) all point to a recessionary backdrop. The depths of the recession are still unknown, but the path of economic data remains clear based on the lagged effects from the inputs of our PIIL model.

Evidence Today’s argument centers around the notion that the economy and, by extension, the capital markets have ALREADY felt the effects of tightening monetary policy. We find this misguided as, historically, it takes roughly 18 to 24 months for the lagged effects to be felt in economic conditions. If we recall, interest rates did not begin their meaningful ascent until March of 2022, which makes this current slowdown a late 2023/early 2024 story. Although one can always argue that “time is different,” we have yet to see a detachment in the relationship between interest rates and economic growth. The chart below shows the granger causality between interest rates and industrial production, a leading economic indicator.

One of our bigger concerns is when we look at an amalgamation of all the leading economic indicators; we are well into levels that have historically been synonymous with recessions. And based on the evidence of the lagged relationship between interest rates and industrial production, which is an important leading economic data point, we believe the path is weighed to the downside. Please note that the S&P 500 is a component and has been, for some time, in the Conference Board’s LEI index. Assuming this relationship holds, we remain skeptical of the current “bullish” attitude the market has taken.

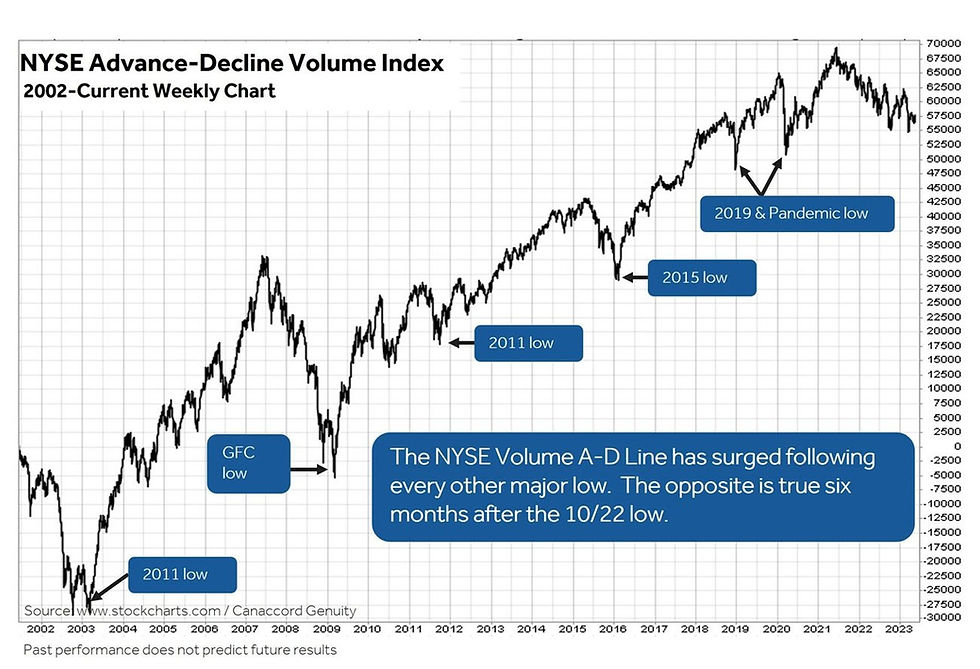

Peculiar Market Action Earlier, during this Coffee with Andrew session, I wrote how peculiar this market has been this year. For some context, as of this writing, the year-to-date S&P 500 market gain has been 15.47%, which seems rather impressive. When looking under the hood, you will see that 75% of this year-to-date return has come from only 7 stocks! In fact, when looking at the S&P 500 equal-weighted index, the price return over the same period has only been 5%. So, while the bulls are cheering, this rally has been led by barely a handful of names which is never a sign of a durable bull market. For further context, micro-cap stocks are down 1.1%, small caps are up 6.4%, and mid-caps are up 7.5% over the same period. The counterargument I typically receive is that out of the handful of stocks leading the market higher, they are AI beneficiaries which is the industry that will save the day, economically speaking. And while I completely agree that AI will revolutionize computing as we know it, the recent price action within semiconductors adds to our list of head-scratching moments. Below is the chart of AMD and Nvidia, which have been the two biggest beneficiaries out of this AI boom relative to the rest of the industry group. If AI was truly the path to lift economic growth, then why aren't most of the players benefitting? Sure, there are fundamental reasons why a stock or two will lag their respective industry group, but typically, we see most boats rise when a sector or industry gets the favorable high tide. Based on recent earnings reports, the return dispersion stems from companies discussing cutting investment as well as waning demand from electronic goods.

Current Strategy

Our DCA Market Model (Risk Asset Allocation) has put emphasis on overweighting defensive equities, which are companies with high pricing power, quality balance sheets, and stable to high earnings growth. We have allocated a small portion of capital to negative beta as we continue to believe risk assets remain susceptible to market volatility and have yet to fully discount the higher probability of a deterioration in credit/economic conditions. Additionally, we are counterbalancing our equity allocation with overweight to cash equivalents that have been providing a roughly 5.5% which is the highest annual yield on the short tenors in roughly 20 years. We continue to monitor our recession checklist, which has 8 out of 9 indicators in recession territory, with employment remaining as the laggard.

Please do not hesitate to contact me with any questions or comments.

Andrew H. Smith

Chief Investment Strategist

DISCLOSURES This publication is for your information only and is not intended as an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. The analysis contained herein does not constitute a personal recommendation or take into account the particular investment objectives, investment strategies, financial situation and needs of any specific recipient. It is based on numerous assumptions. Different assumptions could result in materially different results. All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness (other than disclosures relating to Delos Capital Advisors). All information and opinions as well as any forecasts, estimates and market prices indicated, are current as of the date of this report and are subject to change without notice. In no circumstances may this document or any of the information (including any forecast, value, index or other calculated amount ("Values") be used for any of the following purposes (i) valuation or accounting purposes; (ii) to determine the amounts due or payable, the price or the value of any financial instrument or financial contract; or (iii) to measure the performance of any financial instrument including, without limitation, for the purpose of tracking the return or performance of any Value or of defining the asset allocation of portfolio or of computing performance fees. By receiving this document and the information, you will be deemed to represent and warrant to Delos Capital Advisors that you will not use this document or otherwise rely on any of the information for any of the above purposes. This material may not be reproduced, or copies circulated without prior authorization of Delos Capital Advisors. Unless otherwise agreed in writing, Delos Capital Advisors expressly prohibits the distribution and transfer of this material to third parties for any reason. Delos Capital Advisors accepts no liability whatsoever for any claims or lawsuits from any third parties arising from the use or distribution of this material.

Comments